Mongolia is quickly becoming one of the world’s most

promising economies. This frontier

market in resource rich Central Asia is expected to grow by 20-23% in 2012 with

strong prospects to continue this growth trend.

Only Iraq has a comparable 20-year growth forecast.

Mongolia is quickly becoming one of the world’s most

promising economies. This frontier

market in resource rich Central Asia is expected to grow by 20-23% in 2012 with

strong prospects to continue this growth trend.

Only Iraq has a comparable 20-year growth forecast.

Mongolia’s

vast territory borders the world’s premier emerging market, China. This territory is only 17% explored for

commodities despite the abundance of coal, copper, gold, uranium, and iron

discovered in these areas. China’s proximity and growing demand for such

natural resources puts Mongolia in an ideal position. Consequently, many analysts are expecting a

large mining boom over the next decade in Mongolia.

The

country’s stock market is open to foreign investors but much like its vast

resource rich territory, this market remains underexplored by investors. Mongolia’s equity market was the strongest

performing in the world in 2010, increasing 174% from the prior year. It continued this trend into 2011, during

which it was the world’s second best performing equity market. The Mongolian Stock Exchange (MSE) has a

combined market capitalization of $2.3 billion dollars. The Exchange has made a deal with the London

Stock Exchange Group to modernize the MSE to make it meet world standards.

Like all

frontier markets, Mongolia serves as a hedge against global market

movements. It has a very low correlation

with both developed and emerging markets.

In addition to its proximity to China, Mongolia stands to satisfy demand

for natural resources in Russia, South Korea, and Japan. Note the heterogeneity of its four largest

trading partners. Regardless of the

global macroeconomic environment, the four major developed and emerging

economies on its border will have a need for Mongolia’s resources.

Mongolia

presents investors with a relatively young, highly educated population. Forty percent of the country is under 20

years of age and 98% of the country is literate. Many of these young people will work near one

of Mongolia’s 6,000 rare earth mineral deposits.

|

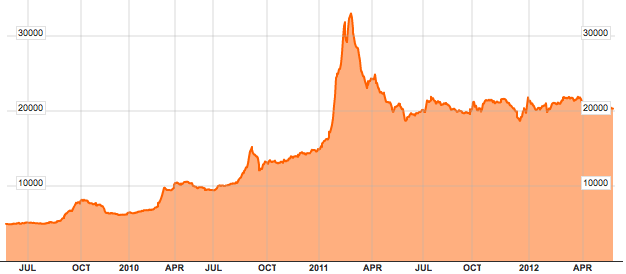

| MSE Top 20 Index |

There is,

as with all frontier markets, a considerable amount of risk involved with

investing in Mongolia. Mongolia is

currently dependent upon China for its exports.

Additionally, political concerns add risk to any investment. Although Mongolia is a Parliamentary

Republic, developing countries have a propensity towards populism and

nationalism. Nationalization remains an

unfortunate risk. However, the Mongolian

government specifically has demonstrated a desire to modernize and become a

reliable member of the global economy.

Investors

interested in exploring the possibility of investing in Mongolia should consult

with their financial advisor to discuss risks and potential returns. AVC Advisory can help interested investors

find an appropriate, well-diversified Mongolian investment fund to invest

in.

0 коммент. :

Отправить комментарий